Debate about British defence procurement often centres on procurement costs.

This takes no account of the cost of keeping a system in service over it's lifetime.

In most cases procurement cost makes up only a small minority of the cost of sustaining a military capability.

The biggest proportion of lifecycle costs is usually operating costs.

Those who base judgements on procuement costs alone with no reference to operating costs are likely to mislead themselves.

Unfortunately it is far more difficult to find accurate published lifecycle costs for military equipment than it is to find procurement costs.

Consequently the following is a neccessarily rough estimate of lifecycle cost for some of the larger current British procurement programs.

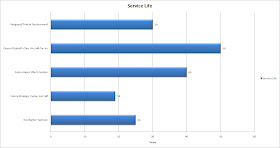

The annualised lifecycle cost given is the total lifecycle cost divided by the number of years in service,this allows for the varying service life of different capabilities and hence is the most useful cost comparator.

Eurofighter Typhoon

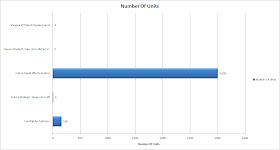

The current planned Typhoon fleet consists of 160 aircraft.

The unit procurement cost is £129 Million per aircraft.

The cost per flying hour of a Royal Air Force Typhoon in 2010 is £70,000,including all capital costs (this may decline in future,in 2009 it was £90,000 per flying hour).

Each of these aircraft has an expected airframe life of 6,000 flying hours.

Assuming each aircraft flies for 240 hours a year,each aircraft will have a service life of 25 years.

This suggests the lifecycle cost of a single Typhoon is £420 Million and the lifecycle cost of the 160 strong Typhoon fleet is £67,200 Million.

This suggests an annualised lifecycle cost of £2,688 Million a year for the Typhoon fleet and £16.8 Million a year for an individual Typhoon.

Future Strategic Tanker Aircraft

Future Strategic Tanker Aircraft (F.S.T.A.) is expected to cost £11,917 Million over it's lifetime.

This equates to an annualised lifecycle cost of £627 Million for each of the 19 years (2016-2035) of full operating capability.

As only 9 (5 others will be available if needed) aircraft will be in Royal Air Force service at any one time,this equates to an annualised lifecycle cost of about £70 Million for each aircraft in service and a total lifecycle cost per aircraft of £1,324 Million.

Future Rapid Effects System

To quote from National Defence Industries (link now dead):

“The programme is broadly split into 3 main groups of vehicles:a protected mobility platform (Group 1), a reconnaissance platform (Group 2) and a direct fire platform (Group 3).

It is the largest ever Army programme with an acquisition value of around £16 billion, and through life costs of £60 billion.”

The Future Rapid Effects System (F.R.E.S.) family of vehicles was expected to replace over 3,000 armoured vehicles has an expected procurement cost of £16,000 Million and an expected lifecycle cost of £60,000 Million over a lifecycle of 40 years.

The unit procurement cost will be £5.3 Million and the total lifecycle cost per unit will be £20 Million.

That gives an annualised lifecycle cost of £1,500 Million a year for the entire vehicle fleet or about £500,000 per vehicle per year.

Note: F.R.E.S has since been split into a number of smaller projects such as F.R.E.S Support Vehicle.

Queen Elizabeth Class Aircraft Carrier

Their annual operating cost has been quoted as £44 Million per ship.

Over the expected 50 year service life of the two aircraft carriers,this gives us a lifecycle cost of £10,300 Million and an annualised lifecycle cost of £206 Million or £103 Million per ship per year.

Vanguard/Trident replacement

The replacement of the strategic nuclear deterrent is expected to cost £15,000 Million - £20,000 Million.

At the upper estimate this gives a unit procurement cost of £5,000 Million.

Operating costs for the next generation nuclear deterrent submarines are not known but the current Vanguard class Trident boats cost £280 Million a year to operate and it is reasonable to suggests the new boats will cost a similar amount.

Over the expected 30 service life of these submarines these figures give a total lifecycle cost of £28,400 Million,using the higher estimate for procurement cost.

This gives a a lifecycle cost per submarine of £7,100 Million.

This gives an annualised lifecycle cost of £947 Million for the deterrent fleet or,£237 Million per submarine per year.

Maybe I missed it, but it seems to me as if you didn't take into account any interest rate (no discount).

ReplyDeleteThis turns the whole calculation into fiscal and economic nonsense. It underestimates the true costs.

First you need to state year xxxx GBP as a base in order to exclude the unknown inflation effects.

Next you need to look at the long-term debt interest rate (or in case of Norway which has reserves instead of debt: capital interest rate) minus inflation rate.

There are financial math formula for the necessary calculations (how to apply the interest rates on the costs of the different years).

States which work on deficits need to think of every new (additional) expense as something which increases debt and thus interest payments. These costs can be huge.

A very thorough financial and economic analysis could alternatively assume a tax increase, and then you need to look at the welfare damages caused by that tax increase. Every buck raised as taxes can cause 2-33% additional damages because of the discouragement of economic activity, expenditures for tax advisers, suboptimal tax dodging activities and for other reasons.

In the end, it's much, much more expensive and you have hidden a major portion of the true costs.

Hello Sven Ortmann,

ReplyDeleteI think you may have misunderstood the whole point of this exercise.

This is a comparison of the relative costs of equipment projects.

It is not about government deficits or the economic benefits of defence spending.

The factors you list apply to all of these projects and are not relevant to this comparison.

GrandLogistics.

Well, for one it's misleading to use essentially wrong costs.

ReplyDeleteSecond, the discounting has a different effect on projects because the distribution of costs is different.

Your point was that operating costs are underestimated. The application of debt interest rates emphasizes early costs, though. That would be the procurement costs. So at the very least you're underestimating the actual share of burden caused by the procurement costs.

Hello Sven Ortmann,

ReplyDeletemy point was not that operating costs are underestimated.

My point was that in most discussions operating costs and service life are rarely mentioned at all despite their importance.

The figures given clearly demonstrate that operating costs are a major factor and often the largest factor in the cost of fielding a system.

They also demonstrate the importance of factoring in service life when considering cost.

Factors which you mentioned such as the economic effect of taxation are of no relevance at all to this subject.

These figures are neither misleading nor wrong.

They are entirely appropriate for the purposes for which they are being used.

I clearly said at the start of the article that figures would be neccessarily rough.

The basis on which the published figures are calculated is not known.

Nor is the timescales and spending profiles of these projects.

Consequently adjusting for inflation or debt interest would be highly inappropriate.

However,as such adjustments have no bearing at all on the point being made it would be unneccessary even it there was sufficient information to make such adjustments.

GrandLogistics.

I understand Sven's concern. If procurement costs were the same percentage of life-cycle cost and the life of the systems was the same they would be directly comparable, but without applying a discount rate for future year expenses you favor systems where procurement costs are a higher percentage of total life-cycle costs and penalize systems with a low up front costs.

ReplyDeleteOn the other hand, if all the discussion centered on procurement costs (as it appears to have been), it unfairly penalize systems with relatively high procurement costs, but long life-cycles and relatively low out year costs.

As Sven suggests the results could be refined and doing so would make the tanker in particular look better and the SSBM look worse, but I don't think it would change the general conclusion with regard to the relative costs.

The FRES and Eurofight programs are far more expensive than the CVF in both upfront and outyear costs.

Have either of you guys heard the phrase spurious accuracy? I think a simple metric which gives an overall idea of up-front costs and recurring costs is useful. A silly metric which attempts to bake in future unknown costs (as accountants and actuaries are fond of doing), gives rise to confusion rather than enhanced decision making accuracy. A good example is some of the nonsense figures bandied about re the F-25 program. As a project risk consultant, in my humble opinion, no human in the history of the world has made accurate or useful projections over a 30 year period, never mind a 50 year period (3 years is reasonable and 5 possible). I would leave longer periods to God.

ReplyDeleteSorry meant F-35

ReplyDelete